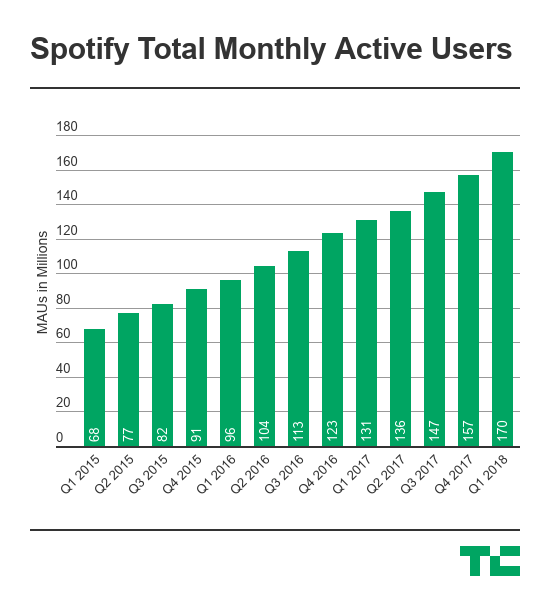

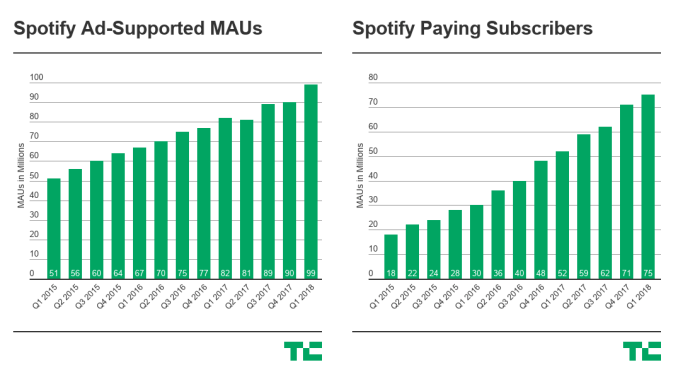

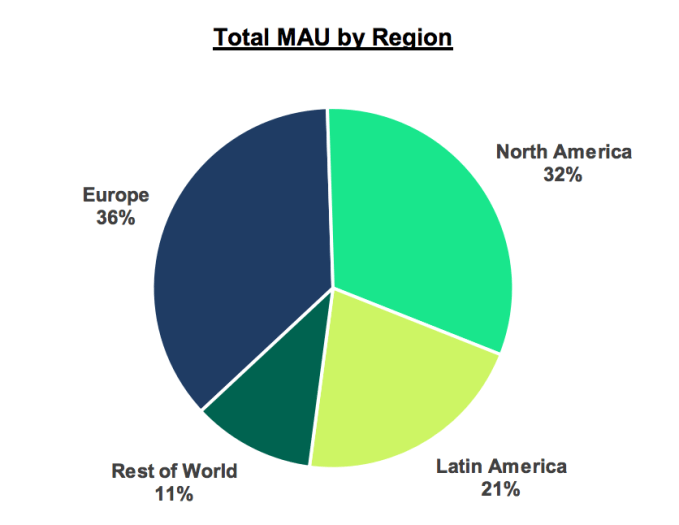

In Spotify’s first ever earnings report, the streaming music came up a little short, pulling in $1.36 billion revenue in Q1 2018. That’s compared to Wall Street’s estimates of $1.4 billion in revenue and an adjusted EPS loss of $0.34. Spotify hit 170 million monthly active users, up 6.9 percent from 159 million in Q4 2017 and 99 million ad-supported users. It also hit 75 million Premium Subscribers, up 30 percent year-over-year, and 75 million paid subscribers, up 5.6 percent from 71 million in Q4 and up 45 percent YoY.

Interestingly, the MAU count indicates that 4 million of Spotify’s 75 million subscribers pay but don’t listen. Spotify confirmed as much. For reference, Apple Music has roughly 40 million subscribers.

Spotify’s results were in line with the guidance it gave yet Wall Street was still disappointed. Spotify shares promptly fell over 8 percent in after-hours trading to around $156, beneath its IPO pop a month ago but still above its $149 day one closing price and $132 IPO pricing.

Spotify’s Gross Margin was 24.9 percent in Q1, over the top of its guidance range of 23-24 percent. Its operating loss was $48.9 million, which improved significantly, and come in under the $59 million to $95 million operating loss Spotify warned of. The music company now has $1.91 billion in cash and cash equivalents at the end of Q1.

As for Q2 guidance, Spotify expects 175 to 180 million MAU, 79 to 83 million paid subscribers, and $1.3 to $1.55 billion in revenue, excluding the impoact of foreign exchange rates. It’s planning an operating loss of $71 million to $167 million, in part due to a $35 million to $42 million expense related to its direct listing debut on the public markets.

During the earnings call, CEO Daniel Ek said he hasn’t seen any significant impact from increased promotion by its competitor Apple Music. In fact, churn hit an all-time low of 4.7 percent, and lifetime value to customer acquisition cost ratio is holding firm at 2.7:1. But overall, “We don’t see this as a winner takes all market” Ek says.

As for voice-activated smart speakers, Ek said “We view it longterm as an opportunity not a threat” since Spotify is available on Google Home and Amazon Alexa devices.

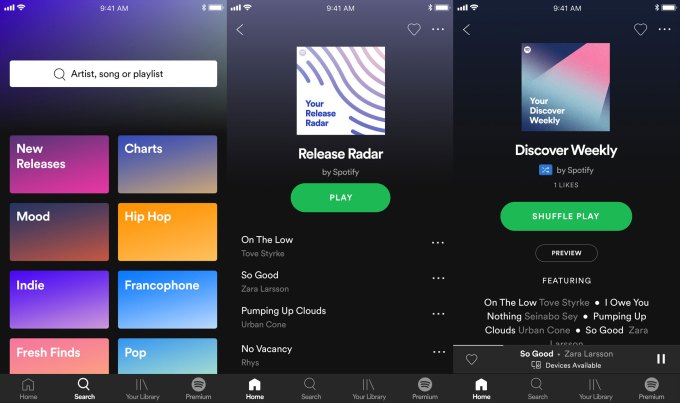

Spotify is hoping to boost paid subscriber numbers by first luring more users to its free ad-supported service. Last month it unveiled a revamped free tier that lets users listen to songs on-demand on particular Spotify-controlled playlists instead of only being able to play in shuffle mode. The idea is that once users get a taste of on-demand listening, they’ll pay to upgrade so they can listen to whatever they want across the whole catalog.

That strategy could not only boost subscriber numbers, but also give Spotify more leverage over the record labels. More than 30 percent of all Spotify listening now happens on its owned playlists. That gives it the power to choose what will become a hit, and in turn means record labels need to play nice. This could help Spotify secure more exclusive content and a better bargaining position in royalty negotiations.

from TechCrunch https://ift.tt/2jpek5s

No comments:

Post a Comment